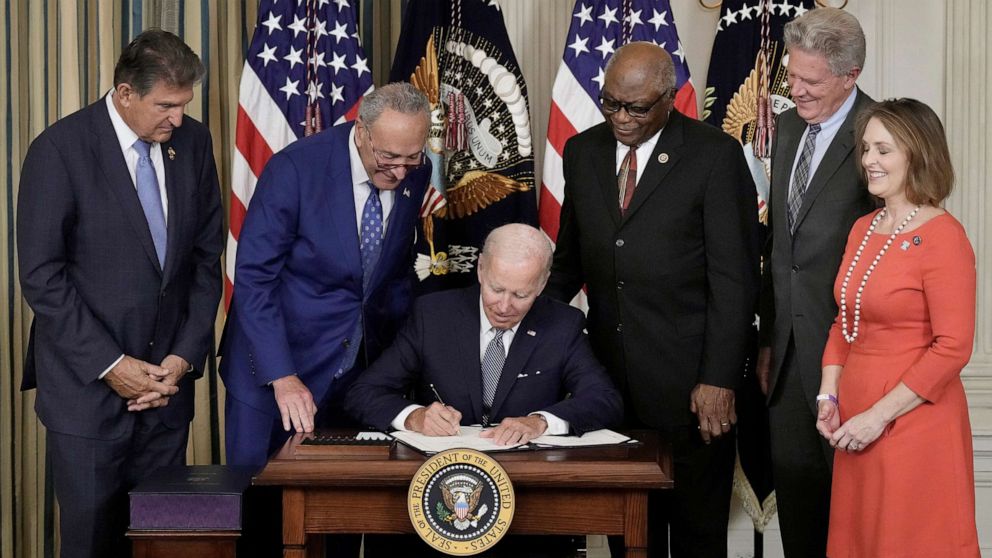

President Biden signed the Inflation Reduction Act (IRA) into law on August 16th. The law includes new spending on climate initiatives, new taxes and enforcement, and drug pricing controls include significant changes to the Medicare Part D benefit. On the surface, measures to address drug pricing has had broad bipartisan support; however, the implications from this law may have unintended consequences to the Part D beneficiaries, payers, as well as to drug development and innovation for years.

Medicare Advantage and Part D plans will experience significant changes in how they administer the drug benefit for beneficiaries. First, a cap of a $35 copay with no deductible for insulin prescriptions goes into effect next year. While insulin products are heavily rebated, payers likely did not account for this change when formulating their bids for 2023. The rebates received may soften the impact of this requirement; however, that does lessen the amount that can be used to lower premiums as well. Furthermore, by 2026, if insulin products are subject to negotiation from CMS, the copay may be even lower depending on the “negotiated” maximum fair price where the beneficiary will pay the lower of $35 or 25% of the maximum fair price.

Next, the amount that payers can increase premiums will be capped at 6% beginning in 2024. This was likely put into place so that payers cannot use premiums to recoup losses or anticipated losses from the requirements included in the law. In 2024, the 5% coinsurance in the Part D catastrophic coverage phase is eliminated. Furthermore, payer responsibility in the catastrophic phase increases from 15% to 20% and then to 60% in 2025 with Medicare decreasing from 80% to 20%. Payers may look at other opportunities within the benefit design, such as deductibles, to address these limits and changes. Other changes to the Medicare benefit include capping of beneficiary out of pocket (OOP) spending to $2,000 from $3,100 in 2023. It also expanded eligibility for the Low Income Subsidy (LIS) while eliminating partial eligibility; it removes cost sharing for ACIP recommended vaccines on Part D; and requires direct negotiation for Part D drugs beginning in 2026 with Part B drugs included beginning in 2028. Payers may have been caught flat-footed as a result of these new requirements. Expect payers to look to manufacturers to help close financial shortfalls through added rebate pressure, additional admin fees, and data fees.

Pharmaceutical manufacturers will also be significantly impacted by the law. Beginning next year, manufacturers will be required to pay rebates to CMS if drug prices rise faster than inflation. This closely aligns Medicare with the Medicaid rebate program. It remains to be seen if these rebates are compensatory or punitive. Using 2021 as the base year for measuring cumulative price changes, the rebate amount is based on units sold in Medicare multiplies by the amount that a drug’s price in a given year exceeds the inflation-adjusted price. Therefore, if a drug’s price has already increased above the consumer price index (CPI-U), the manufacturer will be subject to this new rebate in 2023, unless they decrease the price to align to the CPI-U. While most drug manufacturers make modest price increases annually or semi-annually, the limit imposed by this law may actually motivate manufacturers to maximize their price increases rather than moderating them. Consideration to launch prices will be even more critical when considering the limitation on annual prices increases. The law may actually drive higher launch prices, in order for manufacturers to maximize the revenue in a shorter time frame.

Direct negotiation of prices for Part D drugs begins in 2026 with the addition of Part B drugs beginning in 2028. The number of drugs per year eligible for negotiation is limited as well as how the drugs are identified. For non-biological drugs, they must have been on the market for at least 7 years and not have an FDA-approved generic equivalent. For biological products, they must have been on the market for at least 11 years and not be the reference product for any biosimilar biological product. Orphan drugs for a single rare disease or condition, drugs where Medicare spend was less than $200,000 (in 2021), and Plasma-derived products are also excluded from direct negotiation. While the specifics of how the negotiations will work are being developed by CMS, many of the current blockbusters of today may not be eligible for direct negotiation due to these limitations.

The IRA has brought in sweeping changes to the Medicare Part D benefit and given the Secretary of HHS significant powers to reduce drug spending for Medicare. However, both payers and manufacturers have been significantly impacted by components of this law. Payers and manufacturers have had little time to prepare for these changes both financially and operationally. Expect to see payers react to these changes through added rebate pressure and fees, particularly since they are limited in their ability to increase premiums. Additionally, maximizing manufacturer’s return on investment for new drugs may be limited due to price increase limits, so expect launch prices to be much higher, and increases will be tied closely to the CPI-U, even for those companies who have historically had modest price increases.