American author H.P. Lovecraft wrote that “the oldest and strongest emotion of mankind is fear, and the oldest and strongest kind of fear is fear of the unknown.” And unknown territory is where we are heading when it comes to forecasting payer actions in response to the impending liabilities and costs stemming from the Inflation Reduction Act (IRA). What we know for sure, however, is that payer liability is increasing. Medicare Part D plan sponsors are slated to take on 60% of drug costs in the catastrophic phase (up from 15%) while the 70% manufacturer contribution in the coverage gap phase is eliminated and replaced with a significantly reduced 10% contribution in the initial coverage phase. But then we begin to venture into the unknown. For example, capping beneficiary out-of-pocket costs with the ability to smooth these costs over the plan year could result in lower rates of prescription abandonment, which in turn increase drug utilization and spend. The compounded effect of these dynamics coupled with a 6% limit on premium increases will most certainly result in payer counter strategies. But the question is: How will payers respond and where will they focus their efforts?

In an effort to better understand anticipated payer actions to IRA ramifications, industry thought leaders have preemptively surveyed payers for their insights. The results of these surveys, however, appear to indicate that payers are unsure of exactly how they will respond, but will lean more heavily on tried-and-true formulary management techniques. These include tighter formulary access and stricter utilization management controls, both of which provide leverage in rebate negotiations. PRECISION performed a survey of payers (N=25) shortly after the IRA was first published and found that 64% of respondents anticipated stricter formulary access with preferencing for low wholesale acquisition cost (WAC) drugs including generics and biosimilars. Subsequently, a recent poster from AMCP Nexus 20231 illustrated mixed results among surveyed payers responding to questions about anticipated IRA response actions. In this survey (N=50), 42% of respondents anticipated deploying stricter utilization management controls and conversely, a total of 26% indicated no change or changes on a case-by-case basis. Analyzing results of these surveys are difficult because the insights derived can be come cloudy when combined. For example, would one surmise from these 2 surveys that payers will limit formulary access to lower WAC drugs and implement utilization management controls to prefer these products? This is certainly one possibility, but again we are entering into the world of the unknown.

So, how do we begin to infuse some clarity into forecasting payer response strategies? Perhaps the answer incorporates an additional lens that payers use within the decision-making process: basic financial modeling. Each year, payers look across the entire pharmacy benefit to understand utilization and cost trends within each therapeutic class or market basket in order to identify cost savings opportunities. These opportunities may come through various means such as driving utilization to low WAC drugs or enhancing rebate revenue through the annual bid process. When opportunities are identified, these are then financially modeled with actuarial teams. These models incorporate a number of assumptions, such as the ability of a payer to shift utilization towards preferred drugs with higher rebates or minimize utilization of drugs that have higher net costs. With the cost implications stemming from the IRA, the pressure to nail down assumptions and minimize risks for adding costs is as great as ever. Therefore, at a therapeutic class or market basket level, it will be most important to ensure that net costs are not adversely affected. Let’s look at an overly simplified example to illustrate.

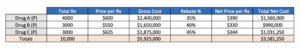

In the following example we have 3 drugs in a market basket (Drug A, Drug B, and Drug C), all preferred on formulary. Prices and rebates vary among the drugs and there is a moderate market leader—Drug A—with a bit more share than its 2 competitors.

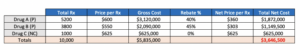

Through the annual bid process, the plan considers limiting formulary access by not covering Drug C. The opportunity will provide enhanced rebates for Drug A and Drug B, while eliminating rebates for Drug C due to formulary removal. Because of the more similar market shares, the scenario also assumes that Drug C will retain 10% of the total market share of the class. If we recalculate the model based on these assumptions, we get the following results:

Based on the assumptions in this scenario, the payer will increase net costs by approximately $65K. From a big picture perspective, this is a small amount, but unlikely the payer takes the deal at face value as there are too many what-ifs to consider. The scenario could net a positive benefit if rebate values for Drug A and B are increased or if the plan is more successful at shifting share away from Drug C. Again, there are many uncertainties, so how does this give us concrete insights into payer response strategies? Actually, it gives us quite a few; here are some examples:

How will payers respond to the IRA?

- Analyze each drug class/market basket individually

- Access decisions will be made at a case-by-case level

- Avoid risky scenarios with too many assumptions; it may be better to maximize discounts across the board than narrow a class

- Narrowing or restricting categories will only work if the plan is certain of financial success

Where will payers focus their efforts?

- Target drug classes and market baskets they can effectively shift share

- Identify drug categories that possess incremental rebate opportunity opposed to classes with minimal mobility for higher rebates

- Deprioritize targeting market leaders even when low net cost options become available (eg, biosimilars); may be too financially risky

- Target removal of drugs with diminishing utilization trajectories

- Target categories with utilization patterns that favor aggressive low WAC products

These insights are not exhaustive, and holes can be poked. Admittedly, there is still a significant amount of “unknown” when it comes to forecasting the access landscape in a post-IRA environment. As such, tracking payer behaviors and continued research will remain a priority. However, industry assessments to date have indicated that payers will be employing traditional tried-and-true tactics (eg, rebate negotiation and utilization management controls) to offset IRA provisions. But what they haven’t indicated, is that they’ll also be using the same traditional techniques to identify cost mitigation opportunities. Therefore, pharmaceutical manufacturers should also use similar methods and models to craft proactive counter-response strategies. It may not be rocket science, but some simple (and traditional) drug utilization analytics can alleviate fears resulting from the IRA’s unknown territories.

References:

- Ford C, Westrich K, Buelt L, Loo V. Payer reactions to the implementation of the Inflation Reduction Act: forecasting future changes to Medicare Part D plans. Presented at: AMCP Nexus 2023; October 16–October 19, 2023; Orlando. https://www.ajmc.com/view/payers-expect-the-inflation-reduction-act-to-financially-impact-medicare-part-d-plan