The oncology pipeline is very robust, and with that comes new competition. One of the top oncology therapeutic classes are antibodies directed against the programmed death 1 (PD-1) or programmed death ligand (PD-L1), which have become the standard of care and improved overall survival for patients in many different types of cancer. There are currently 7 FDA-approved drugs in this class, representing more than 85 oncology indications.1 As additional drugs have entered the market, price competition has not followed. That may change in 2022 if multiple Chinese-developed products currently undergoing FDA review are approved. China is becoming a hot spot for drug development, with China-headquartered companies representing 18% of the early-stage pipeline for next-generation biotherapeutics, up from just 6% five years ago.2 Chinese companies are partnering with larger multinational pharmaceutical companies to bring their products to the US market. In an attempt to gain US market share, several companies have spoken publicly about disrupting the US market based on price, with discounts of 30% to even 70% being tossed around.3 But will they be able to break into a crowded class led by agents that have numerous indications with strong clinical data and real-world US experience?

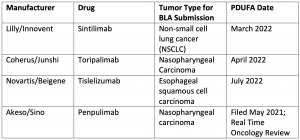

The chart below details Chinese-developed PD-1/PD-L1 inhibitors that have submitted biologic license applications (BLAs) for FDA review. Some are for new indications where there are not currently approved PD-1/PD-L1 inhibitors, such as nasopharyngeal cancer, which is a much more common cancer in China than the US. Others will be approved for indications as direct competitors for existing drugs, such as sintilimab in first-line non-squamous non-small cell lung cancer. The FDA has an Oncologic Drugs Advisory Committee (ODAC) meeting scheduled in February to review the sintilimab BLA, and topics such as the clinical trials being conducted solely in China and applicability to the US population will likely be discussed.4

Selected PD-/PD-L1 inhibitors that may enter the US Market in 20225-8

Pharmaceutical companies, for existing products as well as new entrants, will need to review their payer strategies and ensure that they are well positioned for increased competition. Manufacturers of existing products will need to differentiate based on the strength of their clinical data, including long-term data and real-world evidence, as well as the breadth of their indications. They will also need to closely monitor payer strategies related to the new market entrants and be prepared to react as needed. For new entrants, price alone may not be enough to gain significant market share, especially with limited indications. They will need to show clinical value and drive home savings opportunities in key indications to get payers on board.Some commercial payers have shown increasing willingness to manage in the oncology space, which has historically been hands off. To date, we have seen little or no management of PD-1/PD-L1 inhibitors. If these new agents are approved, the increased competition and potential lower-priced options in some of the more prevalent indications may give payers the nudge they need to consider managing some indications. Some payers have experience in indication-specific management techniques, including in autoimmune disease where different preferred products are selected by indication, based on clinical efficacy, safety, and price. They may look to do the same here. While they may not be able to manage all indications, even driving market share to a lower-priced product in a few key indications may provide the promise of enough savings to make payers willing to manage. However, the clinical data will be extremely important, and payers will need to be confident in the clinical data in the absence of head-to-head trials and will likely lean on NCCN Clinical Practice Guidelines in Oncology (NCCN Guidelines®) for support. Payers will also need to consider the speed at which new clinical information is released and clinical guidelines are updated, as this presents additional challenges to payers in ensuring their clinical policies and any preferred products are updated and clinically sound based on new information.

Although there has been much focus on increased competition in the PD-1/PD-L1 inhibitor drug class, other disruptors are also expected in other key oncology classes. EQRx, for instance, has late-stage drug candidates in the Immuno-Oncology (IO) area but also in other classes which have historically been subject to greater management, as orally administered agents, including a third-generation epidermal growth factor receptor (EGFR) inhibitor for NSCLC and a cyclin-dependent kinase (CDK)4/6 inhibitor for breast cancer. It will be important for manufacturers to continue to monitor the competitive oncology landscape and how payer management may evolve in response to increased competition.

References

- Beaver JA, Pazdur R. The wild west of checkpoint inhibitor development. N Engl J Med. 2021.

- Global oncology trends report 2021. global-oncology-trends-report-2021-05-21-forweb.pdf (iqvia.com)

- EQRx scales disruptive model of important new medicines at lower prices with $500M series B financing. Published January 11, 2021. https://www.eqrx.com/press-release/eqrx-scales-disruptive-model-of-important-new-medicines-at-lower-prices-with-500m-series-b-financing/

- S. Food & Drug Administration. February 10, 2022: meeting of the oncologic drugs advisory committee meeting announcement. https://www.fda.gov/advisory-committees/advisory-committee-calendar/february-10-2022-meeting-oncologic-drugs-advisory-committee-meeting-announcement-02102022-02102022

- BeiGeine announces U.S. FDA acceptance of biologics license application for tislelizumab in esophageal squamous cell carcinoma. Berkshire Hathaway. Published September 13, 2021. https://www.businesswire.com/news/home/20210912005031/en/BeiGene-Announces-U.S.-FDA-Acceptance-of-Biologics-License-Application-for-Tislelizumab-in-Esophageal-Squamous-Cell-Carcinoma

- Innovent Biologics, Inc. U.S. FDA accepts regulatory submission for sintilimab in combination with pemetrexed and platinum chemotherapy for the first-line treatment of people with nonsquamous non-small cell lung cancer. Cision. Published May 18, 2021. https://www.prnewswire.com/news-releases/us-fda-accepts-regulatory-submission-for-sintilimab-in-combination-with-pemetrexed-and-platinum-chemotherapy-for-the-first-line-treatment-of-people-with-nonsquamous-non-small-cell-lung-cancer-301293152.html

- Coherus and Junshi Biosciences announce FDA acceptance of BLA filing for toripalimab for treatment of nasopharyngeal carcinoma. Published November 1, 2021. https://www.biospace.com/article/releases/coherus-and-junshi-biosciences-announce-fda-acceptance-of-bla-filing-for-toripalimab-for-treatment-of-nasopharyngeal-carcinoma/

- Akeso, Inc. Akeso’s penpulimab monoclonal antibody submitted BLA in the United States. Cision. Published May 24, 2021. https://www.prnewswire.com/news-releases/akesos-penpulimab-monoclonal-antibody-submitted-bla-in-the-united-states-301297568.html