Rising Healthcare Costs and the Shift to Value

In healthcare, no topic has drawn more attention among providers, payers, and policymakers than health spending. In 2019, total health spending reached a staggering $3.8 trillion. The Congressional Budget Office projects spending will increase 5.4% annually through 2028 to $6.0 trillion, representing 19.7% of gross domestic product by the end of the period. Notably, price growth for medical goods and services is projected to accelerate 2.4%/year while Medicare spending will increase 7.6%/year due to enrollment growth. In the same period, the insured share of the population is expected to fall from 90.6% in 2018 to 89.4%.1,2

To reduce the rate of annual health spending, policymakers have recognized and begun to make changes to the flawed incentives that currently exist in provider reimbursement: largely that fee-for-service (FFS) reimbursement lends to unnecessary utilization and costs. This effort has led to an increased use of value-based payments, which, by contrast, reward desired results—better outcomes at lower costs. This concept of changing incentives for providers has become a major focus in health policy, especially in the Medicare population, which insures 62.7 million seniors (53.9 million) and disabled adults (8.5 million) at a cost of more than $800 billion.3 Accordingly, 2 laws were passed to accelerate this ongoing transition and incentive alignment from volume to value.

- In 2010, the Patient Protection and Affordable Care Act (ACA) authorized the creation of the Center for Medicare and Medicaid Innovation (CMMI) within CMS (Section 3021), which has since developed more than 50 alternative payment pilot programs that restructure the incentives and reimbursement to align more closely to value-based care. The law specified these:

- 3022. Medicare Shared Savings Program (aka accountable care organizations [ACOs])

- 3023. National Pilot Program on Payment Bundling

- 3024. Independence at Home Demonstration Program

- 3025. Hospital Readmissions Reduction Program

- 3026. Community-Based Care Transitions Program

- 3027. Extension of Gainsharing Demonstration

- In addition to the key programs highlighted above, in 2015 the Medicare Access and CHIP Reauthorization Act (MACRA) instituted the Quality Payment Program (QPP), which led to significant changes for how the Centers for Medicare and Medicaid Services (CMS) can penalize or reward providers for how well they deliver high-value/high-quality patient care. In essence, MACRA linked individual physician participation in APMs with their obligations to adhere to federal standards for quality, safety, and efficiency in their day-to-day patient care activity. The CMS was required by law to oversee the QPP.4

Current Status of APMs

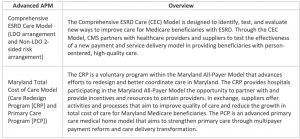

More than 50 APMs and advanced APMs are ongoing under the oversight of CMMI.5 The newest APMs were scheduled to start in January 2021: the Primary Care First Model, which will launch in January 2021 in 26 geographic regions, and the Direct Contracting Model (see tables below).

The Future for APMs

According to CMS, provider participation in APMs has been high, but net savings to Medicare disappointing. At its October 2, 2020, meeting, the Medicare Payment Advisory Commission characterized APMs as a “limited success,” urging CMS to simplify the programs and financial risk-sharing incentives with providers.

APMs vary in design, but all seek to restructure payments to providers in a way that financially incentivizes low-cost, high-value care. The adoption of APMs has progressed well beyond their origins in Medicare. In 2019, 41% of Medicare payments, 30% of commercial payments, 53% of Medicare Advantage payments, and 23% of Medicaid payments were tied to APMs according to the Health Care Payment Learning & Action Network.6 Adoption of APMs across the spectrum of payers—Medicare, Medicaid, private health insurers, and large employers—will continue to increase.

Nonetheless, changes to APMs are likely to occur in the following areas7:

- Simplicity: Fewer models with standardized performance measures for quality, patient experience monitoring, and cost savings

- Financial risk: Increased financial risk-sharing with participants

- Regulation: Reduction of Stark Anti-Kickback restrictions

- Participation: Mandatory participation in certain models

In addition, it is expected that APM utilization will expand to other government health programs such as Medicaid, Veterans Health, marketplace plans, as well as to privately insured populations. In short, APMs will continue to change—and be more important to slowing health spending.

What Providers Need to Consider Next

For provider organizations—physicians, hospitals, and post-acute providers—participation in APM programs is necessary for long-term positioning and sustainability. Strategically, these activities should be viewed as the institutional bridge from FFS reimbursement to value-based payments. How fast, and in what forms, payers encourage/require shared risk participation will vary by market, but it is clear that the federal government (which is the largest payer by share of overall health system revenue) will be the accelerator as it faces head-on significant long-term solvency pressure.

For many provider organizations, a provider-sponsored Medicare Advantage plan may be the destination beyond APM programs, affording a clinically integrated network of providers the opportunity to control the full premium dollar and manage the care and costs for the senior population. Operating a health plan also offers provider organizations the ability to strengthen their relationship with patients, providing a fully integrated experience from member benefits to care delivery.

Significant reductions in FFS reimbursement triggered by reduced utilization experienced early in the public health emergency (PHE) have led providers to increasingly consider risk-based contracts and capitation to improve revenue sustainability. The potential for payment bonuses via APMs and the predictable revenue offered by capitation are driving the trend toward these arrangements. After the PHE, pressure to rein in government deficits caused by pandemic-related spending may reinvigorate efforts to control Medicare and Medicaid costs through APMs, which traditionally have bipartisan support. Given the current financial instability, providers should consider accelerating their transition to APMs, including CMMI direct contracting models and episodic bundling. Payers may also more actively promote the transition to risk-based contracting to improve patient access and increase financial stability for their provider networks.

Navigating the journey from FFS to value is not optional: transitioning successfully will require focused investments and new operating expertise. We believe APMs enable integrated provider organizations to improve value for the communities they serve: better care at a lower cost. We also believe APMs will require more financial risk among participants and finally, we believe that APMs are here to stay.

References

- Keehan SP, Cuckler GA, Poisal JA, et al. National health expenditure projections, 2019–28: Expected rebound in prices drives rising spending growth. Health Aff (Millwood). 2020;39(4):704-714.

- Centers for Medicare & Medicare Services. NHE fact sheet. https://cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet. Revised December 16, 2020. Accessed October 14, 2021.

- Kaiser Family Foundation. A snapshot of sources of coverage among Medicare beneficiaries in 2018. https://www.kff.org/medicare/issue-brief/a-snapshot-of-sources-of-coverage-among-medicare-beneficiaries-in-2018/. Published March 23, 2021. Accessed October 14, 2021.

- Quality Payment Program. APMs overview. https://qpp.cms.gov/apms/overview. Accessed October 14, 2021.

- Centers for Medicare & Medicare Services. Innovation models. https://innovation.cms.gov/innovation-models. Accessed October 14, 2021.

- Health Care Payment Learning & Action Network. What is the Health Care Payment Learning & Action Network? https://hcp-lan.org. Accessed October 14, 2021.

- Chernew The role of market forces in U.S. health care. N Engl J Med. 2020;383(15):1401-1404.

APPENDIX

Advanced Payment Models (APMs) for 2021

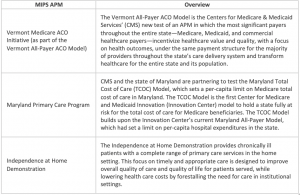

2021 Merit-based Payment System (MIPS) APMs

Eligibility: For eligible clinicians who receive more than $90,000 in Medicare covered services/care for more than 200 Medicare patients and provide 200 or more covered professional services. Participation is mandatory.

Performance Measures: Quality: 40%, Improvement Activities: 15%, Promoting Interoperability: 25%, Cost: 20%

2021 Advanced Alternative Payment Models (AAPMs)

Eligibility: voluntary participation for clinicians who use certified electronic health record (EHR) technology in their practices (minimum of 75% of practices use certified HER technology within APM entity) and agree to significant financial risk in consideration of a 5% incentive payment and to be excluded from MIPS. To become a Qualified Provider (QP), a clinician must receive at least 50% of Medicare Part B payments or see at least 35% of Medicare patients through an Advanced APM entity at one of the determination periods. To become a Partial QP, a clinician must receive at least 40% of Medicare Part B payments or see at least 25% of Medicare patients through an Advanced APM entity at one of the determination periods.