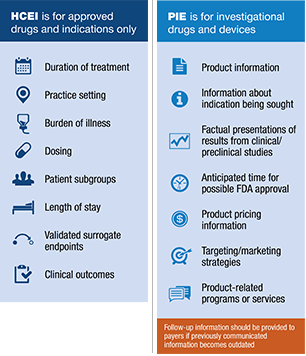

Earlier this year, the FDA released draft guidance to answer common questions regarding the communication of healthcare economic information (HCEI) about medical products, including prescription drugs, to payers pursuant to the approval of the 21st Century Cures Act. The draft guidance also addressed questions related to the dissemination of information about medical products, including investigational drugs and devices, to payers prior to FDA approval or clearance, known as preapproval information exchange or PIE. This guidance represents significant opportunities to evolve and expand the types of evidence that can now be communicated to payer customers, as well as when it can be done. Are payer marketers taking advantage of this new “safe harbor” of information exchange? The answer may surprise you.

Earlier this year, the FDA released draft guidance to answer common questions regarding the communication of healthcare economic information (HCEI) about medical products, including prescription drugs, to payers pursuant to the approval of the 21st Century Cures Act. The draft guidance also addressed questions related to the dissemination of information about medical products, including investigational drugs and devices, to payers prior to FDA approval or clearance, known as preapproval information exchange or PIE. This guidance represents significant opportunities to evolve and expand the types of evidence that can now be communicated to payer customers, as well as when it can be done. Are payer marketers taking advantage of this new “safe harbor” of information exchange? The answer may surprise you.

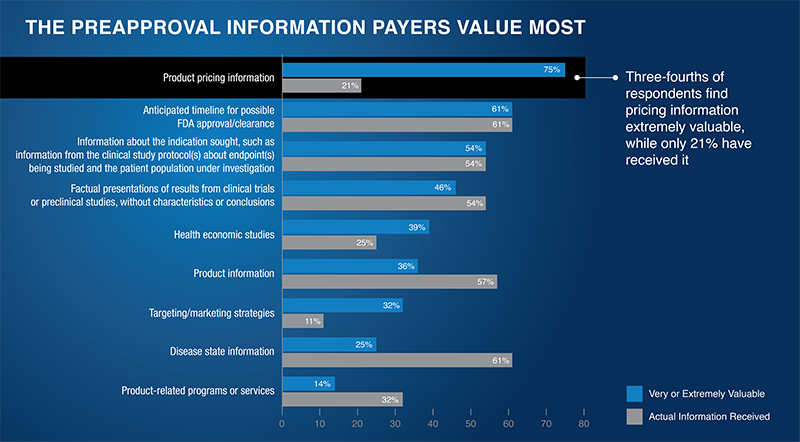

Precision for Value recently conducted a special Rapid Pulse survey—our proprietary high-speed survey and analysis service that provides pharmaceutical marketers with feedback from market access decision makers—focusing on payer perceptions of PIE. In surveying 28 respondents, representing 23 health plans, 5 health systems, and roughly 153 million lives, some of the key takeaways were eye-opening:

- As of yet, payers haven’t noticed a change in the frequency of PIE presentations by pharma marketers

- Payers would like PIE meetings approximately 3 to 6 months prior to approval—in-line with when manufacturers deliver it

- At those meetings, 75% of payers indicated they find product pricing information very or extremely valuable—but only 21% say they’ve received it

- Notably, 61% of payers have received disease state information, but only 25% find it very or extremely valuable

These findings indicate that despite more liberal access policies, pharma marketers may not be taking full advantage of early access communication opportunities. Moderate awareness offers an opening to increase early engagement and collaboration.

Our Rapid Pulse research identifies the opportunity for pharma marketers to better support payer knowledge gaps related to current investigational products. It is essential that pharma marketers understand payer-specific policies for PIE, which payer team has those conversations, and how they interact with manufacturers to best take advantage of these new access opportunities. Precision is here to help.